Power Purchase Agreements (PPAs) are the leading mechanisms through which commercial and industrial energy buyers reduce reliance on fossil fuels, curb emissions, procure EACs (energy attribute certificates), meet compliance mandates, and signal their action against climate change to both internal and external stakeholders.

Volatility in power markets has increased the hedging value provided by PPAs for corporates looking to secure clean energy from renewable sources. Recent events have greatly increased short term power prices, shining light on the role that a PPA can provide in securing a fixed cost of energy over many years to gain certainty and below market rates.

Traditionally, PPAs signed by corporates have been long-term deals for new projects, generally ranging from 10 to 12 years. However, through PPAs for existing assets or short-term PPAs (between 3 and 7 years), businesses can make immediate progress against their goals.

Are Operational Assets a Solution?

Renewable assets that are already producing energy can provide buyers with an immediate short-term solution before a new-build PPA comes into operation. The quick nature of these deals has led to increased demand for operational PPAs on the Zeigo platform in 2022. Corporates seeking an interim solution can buy off the spot market or via a supply contract, whilst waiting for a new-build PPA to kick in.

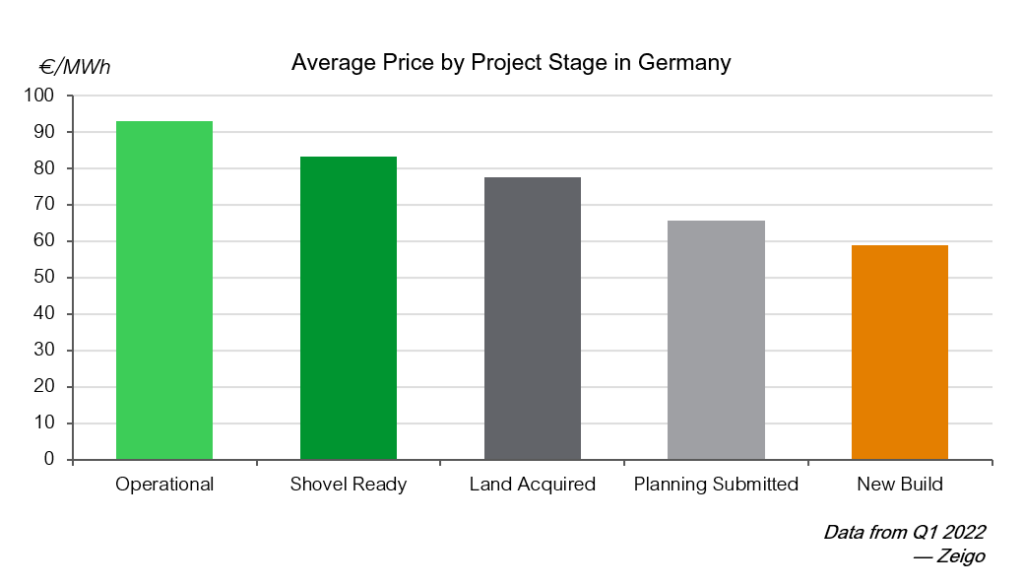

There is a clear trend, however, that operational assets are associated with higher PPA prices relative to new build projects, as more developed projects have progressively less risk that the project will encounter issues and delays (see figure below).

A look at the German Market

In the German market for example, the average offer price during Q1 2022 for operational projects was 37% higher than for a new build asset. However, the increased security of immediate supply, and the simpler contractual process can outweigh higher prices to be a strategic solution for accessing renewable energy within a short time frame. This can provide a green energy opportunity whilst waiting for a longer-term new-build PPA contract to begin.

PPA Duration

For some energy buyers, entering into longer term contractual agreements might be difficult financially or strategically. Shorter terms can provide interim support and access to renewable energy sources without long-term investment. The average length of term for operational assets is currently 7.9 years compared to 12.5 years for project classified as ‘land acquired’, and the smallest length of a Corporate PPA can be just 3 years. For this reason, PPAs under operational assets can work in tandem with new build projects to provide buyers with constant price certainty.

For many companies that have made carbon neutrality goals, EACs are becoming too expensive, and some are in situations where the capital expenditure is becoming too large to maintain the carbon neutral claim with EACs alone. In response to escalating prices, many organizations are considering other clean energy options. Signing a PPA for a new project will take a long time, so there is a risk of lapsing a claim. In demonstrating a commitment to renewable energy, a short term PPA with an operational project can bridge this gap to help companies maintain continuity in claims and trajectory toward their goal while they find more long-term solutions.

Piecing together Operational and Pipeline Projects

Impacts from Russia on the European energy market are expected to be long-lasting meaning EU leaders are indicating an accelerated transition to renewables for greater energy security. PPAs on operational assets are therefore a key element of securing supply and price stability during a period of market volatility, whilst also enabling a swift response to urgent supply contract issues.

Whilst PPAs for new built assets are the most impactful, operational PPAs can fit into a corporate’s sustainability strategy as a stopgap to ensure the company is using clean energy, at a competitive rate with immediate emission reductions.

Corporates looking to sign PPAs can find both operational and new build projects on the Zeigo platform.

This article originally appeared on Schneider Electric’s Perspectives blog.

See Original Post