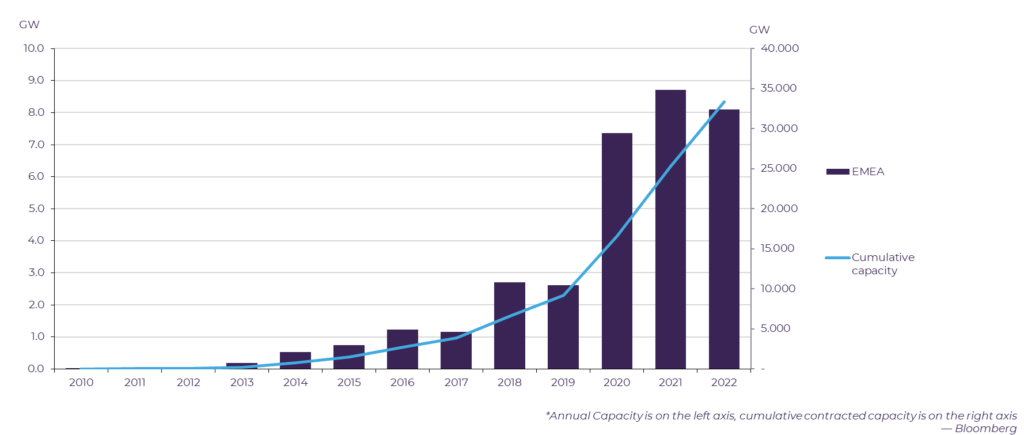

The team at Zeigo Power has been keeping a close watch on the impacts of the war in Ukraine on energy markets throughout Europe. As we have reported in our 2023 State of the European Renewable Energy Market Report, consumers in Europe are still enduring unprecedented price volatility. Though 2023 began with markets declining from highs witnessed in 2022, industry and governments agree that energy prices are unlikely to return to pre-war levels in the near- to medium-term. Continued uncertainty and high prices have left energy buyers seeking solutions that provide price security and a sustainable source of power for their operations.

As a result, the burgeoning power purchase agreement (PPA) industry has been re-charged, as more buyers seek the benefits of price predictability and consistent access to clean power. Despite a smaller number of corporate renewable PPAs signed in 2022 compared to 2021, increased demand in tendering processes on the Zeigo Power platform indicate enduring corporate appetite to adopt renewable energy.

Best Practices Pre-tender

Even before entering a PPA tendering process, it’s important to level set with company decision-makers on timeline and what to expect at different stages. These pre-tender steps help to prepare the team for negotiations, gain the most from a tendering process, and ultimately increase the likelihood of signing a PPA.

A Long-Term Commitment

Any potential buyer should have knowledge of the risks and benefits of a PPA before initiating the tendering process. As PPA are long-term contracts, with an average of over 11 years across Europe, buyers need to understand their energy demand and ability to predict factors (such as business growth, acquisitions, or divestitures) that may influence energy needs in the future. While no demand forecast can be foolproof, the practice of forecasting future energy usage will reduce buyer risk and help right-size the PPA volume. While it is possible to sell excess supply back to the market if consumption does fall below the agreed volume, market price fluctuations could produce less favorable economics. Having long-term commitments and a forward-looking view of the business from the beginning are key.

Internal Approval and Requirements

Although buyers are not committed to a PPA until the final contract has been signed, early leadership education and support for a PPA greatly improves the chances for a seamless tendering process. Having an engaged leadership team enables quicker decision-making, which is especially crucial in today’s environment where competition for projects is high and price fluctuations occur frequently. For example, some of our PPA clients are being faced with developers revising initial offers based on wholesale market prices and supply chain drivers. In these cases, slow internal decision-making could risk a business missing out on a better rate.

Part of the equation to improve decision-making speed is to clearly understand what specifications are required and most critical to meeting the business needs and sustainability goals. This requires an investment of time upfront for internal discussion and alignment on goals but allows for easier evaluation of offers submitted during the tendering process. On the Zeigo Power platform, buyers can specify their requirements to encourage offers that best meet these specifications, and offers are then measured against these requirements with our match score system.

Implementing PPA best practices before submitting a tender is essential for understanding the market, identifying your requirements, aligning your stakeholders, evaluating offers, and executing decisions. Once the tender process is underway, it is equally important to communicate with internal stakeholders and set expectations for typical timelines, especially for first-time buyers.

Typical PPA Tendering Timeline

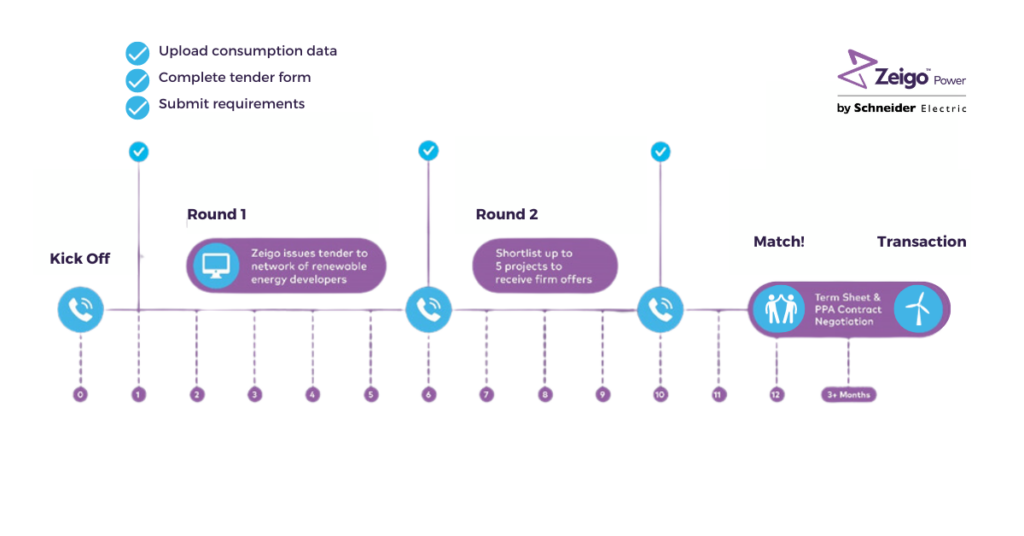

The Zeigo Power platform is designed to accelerate the PPA tendering process for corporates and developers, simplifying the path from tendering to project selection to negotiation to execution. Although variances in tender timelines are common, the following stages are typical of the Zeigo Power process and can help orient a deal team on what to expect throughout.

Weeks 0-1: After joining the Zeigo Power platform, corporates upload their consumption data, complete the tender form, and input their tender requirements.

Weeks 2-5: Zeigo Power initiates the tendering process by notifying renewable energy developers of these requirements. At this point, developers with sites that match these specifications submit an offer with details including the price, technology type, and PPA start date. This stage of the tendering process lasts approximately 4 weeks but can be extended.

Weeks 6-8: Following closure of the round 1 tender, Zeigo Power will conduct analysis to determine which offer most closely matches the requirements of the corporate buyer. Following this analysis, the corporate will shortlist up to 5 offers to take to round 2 of the tendering process.

Weeks 8-10: Shortlisted developers provide detailed site data including site generation patterns to match this against corporate consumption levels throughout the year and may amend round 1 offers. Zeigo Power will provide balancing and shaping analysis to further guide selection of the most suitable offer based on PPA specifications and forward market pricing.

Weeks 11-12: The corporate buyer selects what offer they want to take to Term Sheet negotiations prior to signing into a PPA.

Week 13: Term sheet negotiations begin. The timeline of these negotiations is highly variable and dependent on the needs and flexibility of buying and selling parties; a typical duration is expected to last for 3 months.

Buy Renewable Energy Now

Corporates looking to sign PPAs can find both operational and new build projects on the Zeigo Power platform.

Get StartedThis article originally appeared on Schneider Electric’s Perspectives blog.

See Original Post